- Jun 09, 2025

- 10 min read

8 Crypto Scams to Be Aware of in 2025: A Guide for Businesses and Users

Crypto scams in 2025 are more sophisticated than ever—here are 8 traps even experts fall for and how to avoid them.

Despite the increasing market volatility, crypto enthusiasts express cautious optimism. Bitcoin has surged past the $100,000 mark, riding high on a wave of institutional investment, record demand for spot ETFs, and renewed public enthusiasm. This wave began with a tentative uptick in late 2023, dipped afterward, and has since rebounded into strong bullish momentum. The overall surge was supercharged by the April 2024 Bitcoin halving, Donald Trump's pro-crypto stance, and a macroeconomic climate increasingly favorable to decentralized assets.

Slowly but steadily, a real infrastructure is forming beneath the hype. Crypto is being taken seriously, not just by tech-savvy millennials or DeFi degens, but by governments, asset managers, and even pension funds. As geopolitical tension and economic volatility persist, digital assets are increasingly viewed as a kind of financial safe haven—neutral, borderless, and resilient.

However, this fertile soil is bringing out fraudsters.

Where there’s money, there are scams. And with crypto, the scams are getting more sophisticated, and attacks—more frequent and more dangerous. The rise of generative AI has made it easier than ever to create convincing phishing schemes, fake identities, and deepfake videos—all used to part people from their crypto funds. Every year, new scams emerge, often evolving faster than many platforms or regulators can predict and react.

And the numbers are indeed disturbing. In 2024, Americans lost an estimated $9.3 billion to crypto fraud, according to the FBI.

Crypto has long been hailed as the future of finance—but if that future is going to be inclusive, sustainable, and reliable, both businesses and users need to prioritize security, which is foundational.

If you think you’re too smart to get scammed, you’re already a target. From social engineering playbooks to surgical exploits, crypto scams in 2025 are sharper than ever. Let’s check out the most common scams out there—and the smart practices every user and business should adopt to stay one step ahead of scammers.

8 ways scammers will go after users' crypto in 2025

The popularity of specific crypto scams changes over time. High-yield investment scams and “pig butchering” schemes have become the most common, while AI-driven tactics make crypto fraud more sophisticated and harder to detect. Here’s the list of the most dangerous scams crypto enthusiasts should be aware of in 2025:

1. AI-generated deepfake scams

A deepfake scam uses AI-generated video or audio to impersonate trusted figures—such as family members, CEOs, or influencers—in order to trick victims into sending cryptocurrency or revealing sensitive information. These highly realistic forgeries make scams more convincing and difficult to detect, and their use has been on the rise in both traditional finance and the crypto space.

Suggested read: Fraud Trends for 2025: From AI-Driven Scams to Identity Theft and Fraud Democratization

In recent years, scammers have widely used AI-generated deepfake videos of Elon Musk to promote fraudulent cryptocurrency giveaways on platforms like YouTube. In one documented case from June 2024, a deepfake Musk video was used during a live YouTube stream to solicit funds. The scammer’s wallet received contributions from multiple victims within 20 minutes, ultimately collecting at least $5 million between March 2024 and January 2025. These funds were traced to major exchanges such as MEXC and even to darknet markets.

2. “Too good to be true” investments

Scammers posing as savvy “investment managers” promise sky-high returns—if you just send them some crypto first. It’s classic social engineering, dressed up as financial opportunity.

These scammers usually have legitimate-looking websites or well-designed apps, using fancy investing jargon to seem real.

In May 2025, a resident of Warriewood, Australia, reported a loss of nearly $64,000 to a cryptocurrency investment scam. The victim was initially contacted via the Signal messaging app in June 2024 about an investment opportunity, starting with a $500 outlay and a promise of a tenfold return. He invested more with a company called Ultra Trade Investments, encouraged by the promised returns. However, when attempting to withdraw profits, he was told to pay additional fees. Over several months, he continued to pay and realized it was a scam when he could not recover his funds.

That same month, a 57-year-old woman from Limassol, Cyprus, was convinced to do fraudulent “cryptocurrency investments” during November and December. The scam came to light when she unsuccessfully tried to withdraw her supposed profits—resulting in a total loss of 37,000 euros ($41,600).

3. DeFi rug pulls

In 2025, DeFi rug pulls are a growing form of cryptocurrency scam where developers of a decentralized finance project suddenly withdraw all user funds and disappear, leaving investors with worthless tokens. These scams are becoming more complex, with tactics such as "honeypot tokens" (where malicious smart contracts prevent users from selling the tokens) and multi-wallet control strategies to evade detection.

Rug pulls have decreased in frequency by 66% year-over-year, with only 7 incidents recorded in early 2025 compared to 21 in the same period of 2024. However, the financial damage has skyrocketed. Losses from this scam reached nearly $6 billion in early 2025, up from $90 million in early 2024.

The nature of rug pulls is evolving, with a shift from DeFi protocols and NFT projects in 2024 to predominantly memecoin-related rug pulls in 2025. Memecoins have often been behind these schemes, as the hype around them rapidly gains traction before scammers disappear with user funds.

One recent high-profile case is the Meteora memecoin scam. The lawsuit accused Meteora, its founder Benjamin Chow, venture firm Kelsier Labs, and several executives of manipulating the price of the Solana-based M3M3 token for personal profit at the expense of public investors. According to the complaint, insiders used over 150 wallets to acquire up to 95% of the token supply within 20 minutes of its launch, while restricting access to public buyers. This allowed them to artificially inflate the token’s price through coordinated internal trading. Once the price spiked, the insiders allegedly sold off their holdings, triggering a sharp market crash. The suit claims that investors lost over $69 million between December 2024 and February 2025. Filed in the US District Court for the Southern District of New York, the lawsuit also seeks to classify stake-based meme coins as securities, which aims to bring greater regulatory clarity to similar crypto assets.

Another notable example is Kokomo Finance rug pull. Developers of this DeFi lending protocol on Ethereum’s Optimism network disappeared with over $5.5 million in user funds. They initially deployed legitimate code but later switched to a malicious version to drain liquidity. The project’s website and social media were deleted soon after.

4. Phishing

Phishing is a classic scam that’s now widespread in the crypto world. It’s used to compromise login credentials, such as crypto wallet keys. Usually scammers send an official-looking email that asks the victim to log in to their account—which is actually a trap:

In one documented case, a victim from California was scammed by an individual impersonating a support team member of the DeFi project Arkadiko Finance. After the victim posted a question in the project's official Discord support channel, the scammer quickly created a private message thread, posing as a community leader offering assistance. The scammer directed the victim to a fraudulent website, ren.digl.live, and instructed them to verify their wallet on the site. Trusting the request, the victim entered their wallet’s seed phrase into the platform. After receiving an error message, the victim attempted to resubmit the phrase. Shortly after, the platform became unresponsive. Within an hour, the victim discovered their crypto wallet had been compromised. They report a loss of at least $100,000 as a result of interacting with the fake site.

Phishing scams often serve as the entry point for ransomware by tricking users into clicking malicious links or downloading infected files. Once inside, the ransomware encrypts personal data or accesses crypto wallets, then demands cryptocurrency payments to unlock access—blending deception, malware, and extortion in one attack.

For example, a California resident was scammed via a fake crypto-airdrop link, which led to their hardware wallet being hacked and a loss of $7,855. The scammers then demanded additional payments to "unstake" the assets, a form of ransomware/extortion targeting a person.

Suggested read: How to Ensure Security When Using Blockchain

5. False giveaways

A crypto giveaway scam is when fraudsters pose as legit cryptocurrency exchanges, businesses, or notable individuals to deceive victims into sending them cryptocurrency. They typically promise to return double or triple the amount sent by the victim—only to vanish with the funds once received.

These scams are frequently promoted on social media platforms like X and YouTube and often involve fake websites resembling legitimate exchanges or companies.

In 2025, crypto scammers are increasingly using deepfakes to impersonate famous figures—like Elon Musk (once again!) and Donald Trump—to promote fraudulent giveaways on X.

6. Pig butchering scam

Pig butchering is a long-term scam where fraudsters build trust—often through romance or social networking—before convincing a victim to invest in fake crypto platforms. Once the victim has deposited significant funds, the scammer disappears, taking all the money. It’s called this way because scammers “fatten up” their victims with attention and trust before “slaughtering” them by stealing their funds.

According to estimates, more than $75 billion USD may have been stolen from victims worldwide through pig butchering scams since 2020. Chainalysis reports that pig butchering scam activity grew in 2024. And this trend is likely to persist in the following years.

In April 2025, a woman from Maryland, US, lost millions of dollars in a pig butchering scam, where scammers (allegedly based in Southeast Asia) gained her trust and convinced her to invest increasing amounts into fraudulent crypto accounts. After the initial scam, she was targeted again by fake “recovery” companies promising to retrieve her lost funds for a fee—a common secondary fraud tactic.

Suggested read: Pig Butchering: Inside the Billion-Dollar Scam Factories

7. Pump-and-dumps

The oldest trick in the book: blow up the hype, sell at the top, vanish before the crash. In pump-and-dumps, fraudsters artificially inflate the value of a crypto asset by generating fake hype—often through social media—to create the illusion of high demand. This drives up the price, making it difficult for investors to ignore. Once the price is high enough, the scammers immediately sell—or “dump”—the asset, causing a collapse in its price.

Pump-and-dump schemes continue to be a widespread form of crypto market manipulation. According to Chainalysis, in 2024, 3.59% of all launched tokens show patterns that may be linked to pump-and-dump schemes.

Another report conducted by Solidus Labs has uncovered wide fraudulent activity on the Solana blockchain, with 98.6% of tokens launched on Pump.fun being chalked down as rug pulls or pump-and-dump schemes.

8. Crypto drainers

A crypto drainer is a malicious script or a smart contract designed to steal cryptocurrency directly from users’ wallets by tricking them into connecting their wallets and unknowingly authorizing transactions that transfer their funds to the attacker. Unlike traditional phishing that steals login credentials, drainers rely on deceiving victims into signing fraudulent transactions, often through fake websites, airdrops, or malicious browser extensions, enabling rapid and automated theft of assets. These scams have evolved into a "drainer-as-a-service" model, where ready-made malware kits are sold to criminals, making crypto drainers a growing and sophisticated threat in the Web3 ecosystem.

At the end of 2024 Kaspersky reported a 135% surge in interest for crypto-stealing drainers on the dark web.

Crypto scams businesses should watch out for in 2025

This year, crypto companies are also navigating a rapidly shifting threat landscape, including deepfake scams and ransomware.

In early 2025 total ransomware payments dropped 35% due to stronger law enforcement and growing victim resistance, however, the threat remains. Attackers are adapting quickly—rebranding old ransomware strains, shortening negotiation times, and exploiting trusted vendors to access multiple organizations. Groups like LockBit and Clop remain active, and emerging players such as Anubis and Linkc Pub continue targeting global enterprises.

Scammers also try to reach businesses through third-party vendors. Compromised tools used by crypto companies can inject malicious code or steal data. This turns supply chains into attack vectors. Past breaches like SolarWinds show how a single vendor compromise can affect hundreds of businesses.

Deepfake-driven employee impersonation is another threat. This fraud trend is expected to persist in the coming years across all industries. Fraudsters mimic CEOs and CFOs to trick teams into making wire transfers or approving fake partnerships. In 2025 alone, deepfake crypto scams caused over $200 million in losses. These scams thrive in remote or fast-paced environments where identity checks are weak.

Phishing remains a go-to tactic. Generative AI is the best friend of all scammers in 2025, so attackers can craft highly convincing fake emails, dashboards, and chats to steal employee credentials. Once inside, they gain backend access or directly drain user funds.

DeFi platforms face threats from drainer scams. These imply a malicious code injected into wallets or SDKs that siphons funds. They often go unnoticed until it’s too late, especially when embedded in legitimate-looking integrations.

Credential stuffing continues to plague businesses. Attackers reuse leaked credentials to access dashboards or customer accounts, making strong MFA and breach monitoring essential.

Synthetic IDs and money mule networks remain a key concern. Fraudsters use fake documents and AI-generated identities to launder money, often slipping past verification systems. If missed, these activities can lead to compliance breaches and regulatory penalties.

Smart contract and governance exploits round out the threat landscape. Attackers can manipulate DAO votes or exploit code flaws to hijack funds or take control of projects.

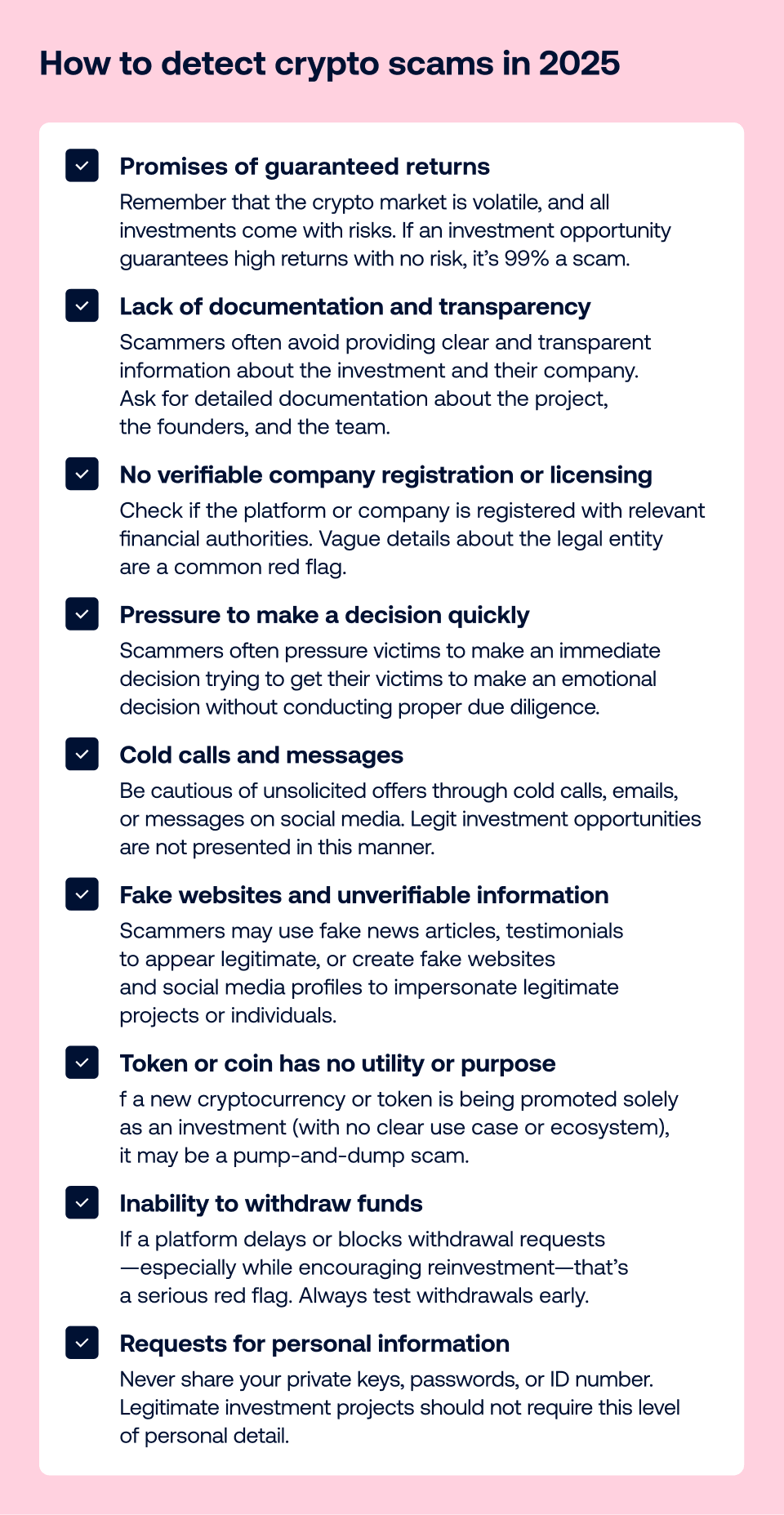

How to detect crypto scams in 2025 and beyond

Crypto scams can take many forms. Fraudsters use various psychological tricks and can be extremely convincing. It’s essential to keep your customers informed, remind them to conduct thorough research, and exercise caution when considering any crypto-related investment or a business opportunity. If someone promises easy and guaranteed returns—it’s likely a scam. Legitimate projects will offer detailed documentation, disclose their team, and operate transparently. If a platform avoids questions, pushes for rushed decisions, or lacks verifiable registration, that’s not even a red flag, it’s a burgundy red flag. Protect your personal info and always do your own research.

Here’s how crypto scams can be detected:

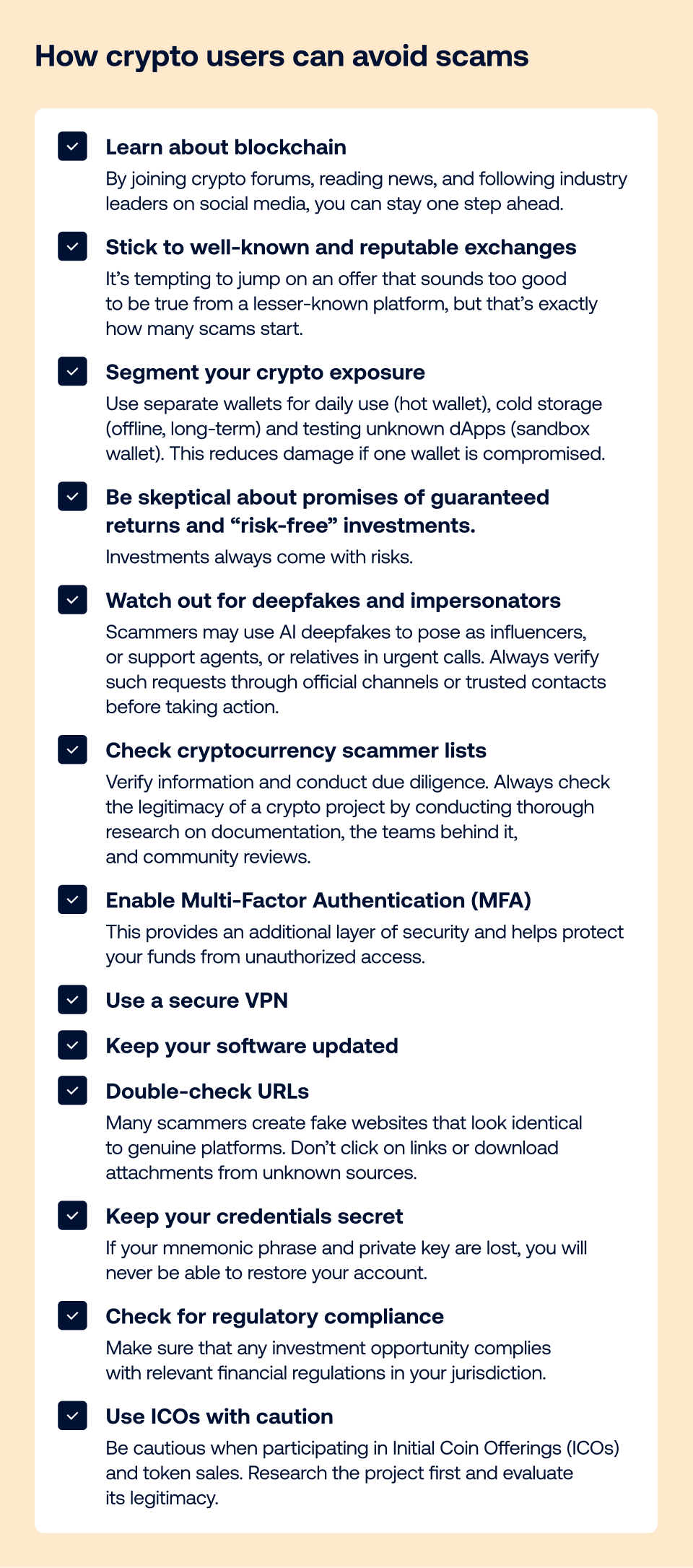

How crypto users can avoid scams

Start by learning the basics—understand how blockchain and cryptocurrencies work. The more knowledgeable you are, the easier it is to spot a scam. Staying active in crypto communities, reading the latest news, and following reputable voices on social media can help you stay one step ahead.

When trading or investing, always use established, well-known exchanges. Offers from unknown platforms may be tempting, but that’s often where scams begin. Another smart move is to segment your crypto exposure. Use separate wallets: a hot wallet for daily use, a cold wallet for long-term storage, and a sandbox wallet for testing new decentralized applications. This approach limits the damage in case one wallet is compromised.

Be cautious of any project or person promising “guaranteed returns” or “risk-free investments.” No legitimate investment is ever without risk. If someone asks you to urgently send crypto, always verify the request through another channel or a trusted contact.

It’s also wise to consult public scam lists and trackers to see if a platform or token has been flagged. Verify information by researching the team, reading documentation, and checking reviews. Enable Multi-Factor Authentication (MFA) on all your accounts and wallets, and use a secure VPN whenever possible. Regularly update your software and double-check URLs. Many scam websites look identical to legitimate ones but have slightly altered web addresses.

Protect your private keys and mnemonic phrases at all costs. If lost or stolen, you won’t be able to recover your funds. Store them securely and offline using tools like hardware wallets. Before investing, make sure the project complies with your local financial regulations, and don’t hesitate to consult a trusted cryptocurrency advisor if you’re uncertain.

Here’s the checklist for your convenience:

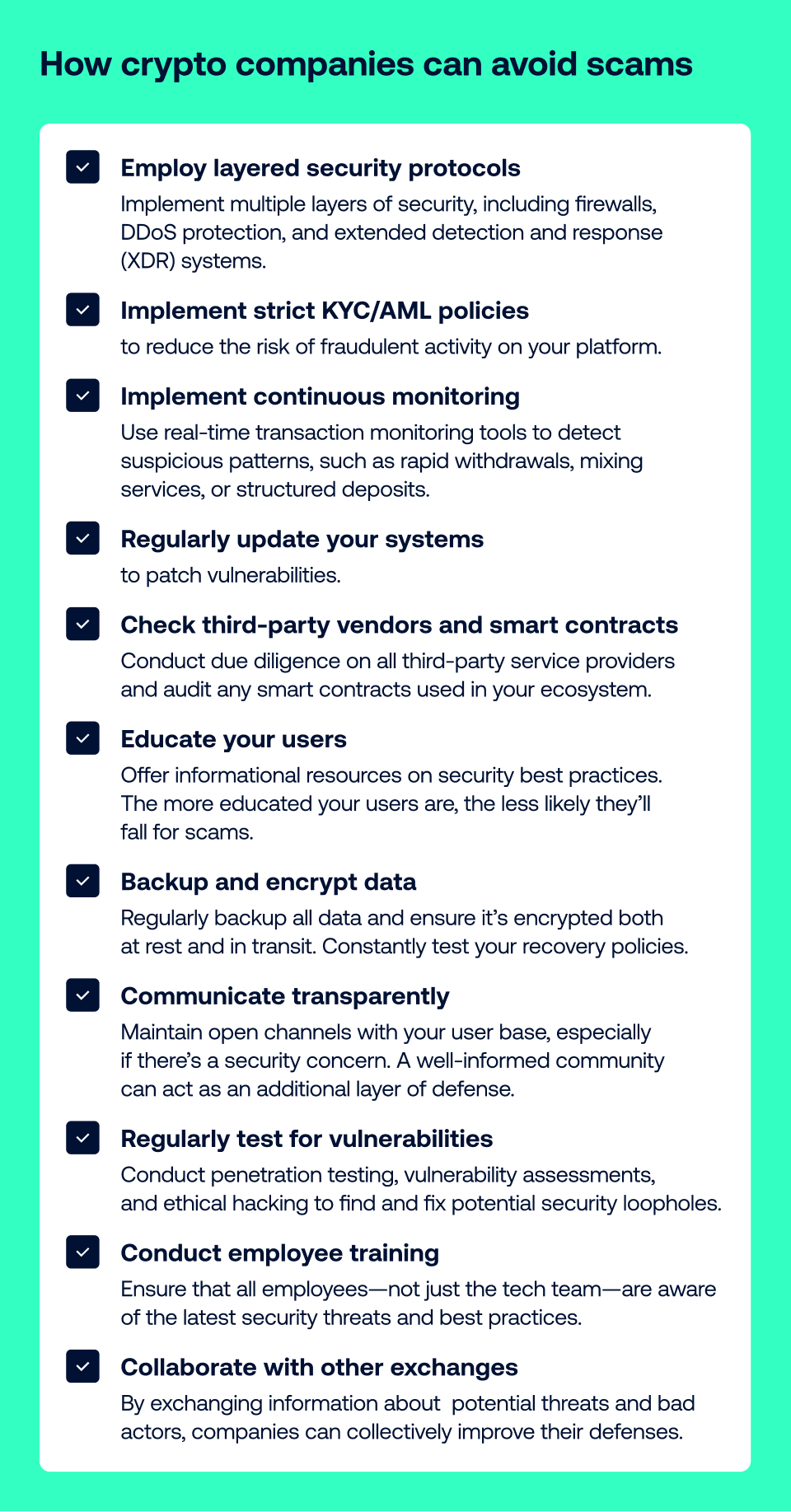

How crypto companies can avoid scams

To protect from attacks in 2025, crypto companies should adopt a robust, multi-layered security approach. This would include a combination of firewalls, DDoS protection, and Extended Detection and Response (XDR) systems. At the same time, strict KYC and AML compliance processes are essential to deter fraud and maintain trust with users and regulators.

Real-time transaction monitoring can detect red flags like rapid withdrawals or suspicious deposits. Regular system updates and audits of third-party vendors and smart contracts close common attack vectors. Many breaches stem from insecure integrations, which makes diligence crucial.

Educating your user base on crypto security best practices not only protects them but also strengthens your platform’s defenses. Likewise, regular backups, encryption, and tested recovery procedures make sure business continuity is smooth. Open, transparent communication builds community trust and helps detect threats early.

Don’t overlook your internal team—ongoing employee training is vital, as human error often leads to breaches. Finally, collaborate with other exchanges to share threat intelligence and collectively raise industry security standards.

Download our comprehensive checklist to help crypto businesses strengthen their security posture:

How to report crypto scams in 2025

If you’ve encountered a crypto scam, it’s crucial to immediately report it to:

- Law enforcement. They can investigate and take action against scams that operate within your jurisdiction.

- Federal authorities, such as the Federal Trade Commission (FTC) and the Federal Bureau of Investigation (FBI) in the United States.

- Financial regulators. In many countries, financial regulatory authorities oversee and investigate fraudulent financial activities, including crypto scams.

- Social media platforms, if you come across crypto scams on Facebook, X, etc.

When reporting, provide as much information as possible, including details about the scam, the individuals, firms, or apps involved, and any communication you’ve had with them (emails, messages, screenshots, transaction records, etc.).

Reporting scams is a crucial step in combating cryptocurrency fraud, protecting others, and potentially recovering lost funds. Besides, educating others about the risks can help with crypto fraud prevention.

FAQ

-

How do crypto scams work?

Crypto scams work by deceiving individuals through various tactics, such as phishing, fraudulent investment schemes, impersonation, and more. The goal is to trick victims into sending crypto to the scammers, who then disappear without delivering the promised “return on investment”.

-

How can you spot a cryptocurrency scammer?

You can spot a cryptocurrency scammer by recognizing red flags and warning signs, such as unsolicited offers, lack of transparency, and pressure tactics to make quick decisions, while also conducting thorough research and due diligence before engaging in any cryptocurrency transaction or investment.

-

What are the red flags for crypto scams?

Red flags for crypto scams include:

- unsolicited offers

- promises of guaranteed high returns with no risk

- lack of transparency

- pressure tactics

- requests for personal information.

-

How can we prevent cryptocurrency scams?

Crypto fraud prevention includes:

- Staying informed about scam trends

- Learning as much as you can about the crypto world

- Being skeptical

- Backing up data

- Avoiding pump-and-dump schemes

- Using secure VPN and keeping your software updated

- Conducting thorough research and due diligence

- Prioritizing security measures (adding extra layers of security, e.g.firewalls, DDoS protection)

-

What is the penalty for cryptocurrency fraud?

The penalties for crypto fraud vary depending on the jurisdiction. They may include fines, imprisonment, asset forfeiture, and civil penalties, or a combination.

Relevant articles

- Article

- 2 weeks ago

- 10 min read

AI-powered romance scams are rising fast. Learn how dating fraud works and how platforms and users can protect themselves from online deception.

- Article

- 2 days ago

- 6 min read

What counts as proof of address in the UK? See accepted documents and how to open a bank account if you’ve just moved to the country.

What is Sumsub anyway?

Not everyone loves compliance—but we do. Sumsub helps businesses verify users, prevent fraud, and meet regulatory requirements anywhere in the world, without compromises. From neobanks to mobility apps, we make sure honest users get in, and bad actors stay out.